HOUSTON--(BUSINESS WIRE)--Contango ORE, Inc. (“CORE” or the “Company”) (OTCQB: CTGO) announced today that it filed its Form 10-Q for the quarter ended March 31, 2016 with the Securities and Exchange Commission.

The Company reported a net loss of $0.2 million or ($0.05) per basic and diluted share for the three months ended March 31, 2016 compared to a loss of $0.3 million or $(0.09) per basic and diluted share for the same period last year as restated. For the nine months ended March 31, 2016, the Company reported a net loss of $0.9 million compared to a net loss of $2.0 million for the same period last year.

Peak Gold, LLC (“Peak Gold”), managed by our Joint Venture partner Royal Alaska, LLC (“Royal Alaska”), a wholly owned subsidiary of Royal Gold, Inc. (‘RGLD”), expended approximately $1.9 million in the three months ended March 31, 2016 for our first ever winter exploration program (“Phase I”) and for project management of the Peak Zone gold deposit discovery on its Tetlin properties near Tok, Alaska. The winter drilling program was conducted during February and March, 2016, was road-supported using a single drilling rig and was designed to test specific targets in the greater Peak deposit area. During Phase I, Peak Gold completed 4,040 meters (13,255ft) of diamond core drilling in 19 holes at the North Peak, West Peak, Two O’clock and Connector zones. Royal Alaska will earn up to 40% interest in Peak Gold by contributing up to $30 million to the joint venture company by October 31, 2018. Of this amount, Royal Alaska has contributed $8.4 million to Peak Gold of which, $1.8 million was held in cash equivalents at March 31, 2016. As of March 31, 2016, Royal Alaska has earned 6.8% member’s equity interest in Peak Gold.

Brad Juneau, President and CEO of the Company, commented, “The winter drilling program was successful in expanding the known limits of both the Peak and North Peak zones, and perhaps most importantly found new, significant mineralization in its first drill hole in the Connector Zone that may lead to a better understanding of the relationship between Peak and North Peak and possible further expansion of the mineral system (see attached location map and Table of Significant Mineral Intercepts). It was previously thought that the Peak and North Peak areas were separate zones, but the mineralization found at the Connector Zone (Hole 16210) more than 200 meters from the nearest existing known mineralization at Peak/North Peak may be part of a single, larger gold system. We expect the 2016 summer drilling program (“Phase II”) to begin in mid-May as follow-up to the promising results from the winter program to further explore the new geologic model potential, as well as test previously undrilled areas. We believe these winter drilling results have the potential to increase the known resources significantly but we cannot provide any revised estimates of resources until the summer program is completed and a new resource estimate is completed next spring.

We expect Peak Gold to pursue a drilling program that is flexible taking into account real time results as they become available. We appreciate the open communication and cooperation that our partner Royal Gold has provided to the Company, and are particularly pleased that the winter operations were completed with no lost time accidents or environmental issues.”

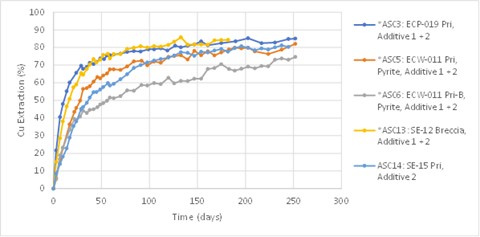

Sample intervals are calculated using 0.5 grams per tonne (gpt) lower cut off for gold with no internal waste less than cutoff grade that is greater than 3 meters in thickness. Intercepts shown are drill intercept lengths. True width of mineralization is unknown. The grade cutoff for gold (Au) is 0.5 gpt; for silver (Ag) is 10 gpt; and for copper (Cu) is 0.1%. The following table summarizes the significant drilling results obtained to date for Phase I of the 2016 Program:

| Zone | Drill Hole | From | To | Interval | Au_opt | Au_gpt | Ag_gpt | Cu (%) | ||||||||||||||||

| North Peak | TET16192 | 31.34 | 38.29 | 6.95 | 0.023 | 0.784 | 2.5 | 0.023 | ||||||||||||||||

| North Peak | TET16192 | 42.00 | 43.42 | 1.42 | 0.053 | 1.803 | 1.5 | 0.021 | ||||||||||||||||

| North Peak | TET16192 | 78.51 | 91.78 | 13.27 | 1.435 | 49.194 | 4.5 | 0.035 | ||||||||||||||||

| including | 80.96 | 81.59 | 0.63 | 12.133 | 416.000 | 26.7 | 0.066 | |||||||||||||||||

| North Peak | TET16192 | 102.84 | 105.46 | 2.62 | 0.074 | 2.536 | 4.5 | 0.151 | ||||||||||||||||

| North Peak | TET16192 | 122.07 | 123.79 | 1.72 | 0.112 | 3.850 | 1.1 | 0.067 | ||||||||||||||||

| North Peak | TET16192 | 139.90 | 143.78 | 3.88 | 0.116 | 3.992 | 3.1 | 0.119 | ||||||||||||||||

| North Peak | TET16193 | 85.91 | 90.62 | 4.71 | 0.363 | 12.452 | 3.6 | 0.065 | ||||||||||||||||

| including | 88.09 | 89.71 | 1.62 | 0.816 | 27.974 | 5.9 | 0.041 | |||||||||||||||||

| North Peak | TET16195 | 66.50 | 68.34 | 1.84 | 0.196 | 6.718 | 3.7 | 0.069 | ||||||||||||||||

| North Peak | TET16196 | 65.78 | 69.12 | 3.34 | 0.021 | 0.712 | 14.1 | 0.096 | ||||||||||||||||

| West Peak | TET16199 | 21.09 | 23.13 | 2.04 | 0.101 | 3.462 | 6.9 | 0.037 | ||||||||||||||||

| West Peak | TET16199 | 50.19 | 52.08 | 1.89 | 0.040 | 1.375 | 0.7 | 0.022 | ||||||||||||||||

| West Peak | TET16199 | 55.62 | 57.79 | 2.17 | 0.053 | 1.805 | 0.0 | 0.005 | ||||||||||||||||

| West Peak | TET16199 | 80.44 | 82.76 | 2.32 | 0.045 | 1.529 | 1.9 | 0.054 | ||||||||||||||||

| West Peak | TET16199 | 95.08 | 96.63 | 1.55 | 0.078 | 2.690 | 0.9 | 0.006 | ||||||||||||||||

| West Peak | TET16199 | 139.46 | 145.31 | 5.85 | 0.020 | 0.699 | 1.1 | 0.030 | ||||||||||||||||

| North Peak | TET16204 | 50.41 | 53.34 | 2.93 | 0.032 | 1.100 | 5.2 | 0.189 | ||||||||||||||||

| North Peak | TET16204 | 63.06 | 65.42 | 2.36 | 0.060 | 2.050 | 1.1 | 0.044 | ||||||||||||||||

| North Peak | TET16204 | 194.11 | 195.93 | 1.82 | 0.477 | 16.338 | 328.4 | 0.157 | ||||||||||||||||

| North Peak | TET16205 | 65.07 | 70.61 | 5.54 | 0.028 | 0.954 | 2.8 | 0.165 | ||||||||||||||||

| North Peak | TET16205 | 82.91 | 83.67 | 0.76 | 0.196 | 6.715 | 11.2 | 0.005 | ||||||||||||||||

| North Peak | TET16205 | 150.74 | 151.73 | 0.99 | 0.098 | 3.360 | 4.2 | 0.314 | ||||||||||||||||

| North Peak | TET16206 | 60.95 | 104.38 | 43.43 | 0.105 | 3.611 | 2.1 | 0.108 | ||||||||||||||||

| including | 98.34 | 100.04 | 1.70 | 0.895 | 30.700 | 2.3 | 0.108 | |||||||||||||||||

| North Peak | TET16207 | 92.88 | 95.92 | 3.04 | 0.076 | 2.590 | 1.4 | 0.057 | ||||||||||||||||

| West Peak | TET16208 | 55.02 | 58.20 | 3.18 | 0.074 | 2.543 | 0.5 | 0.005 | ||||||||||||||||

| West Peak | TET16208 | 88.66 | 108.65 | 19.99 | 0.082 | 2.822 | 0.1 | 0.006 | ||||||||||||||||

| including | 95.55 | 97.45 | 1.90 | 0.351 | 12.050 | 0.5 | 0.011 | |||||||||||||||||

| and | 98.93 | 100.02 | 1.09 | 0.414 | 14.200 | 0.7 | 0.013 | |||||||||||||||||

| West Peak | TET16209 | 46.33 | 48.95 | 2.62 | 0.065 | 2.222 | 0.8 | 0.007 | ||||||||||||||||

| West Peak | TET16209 | 52.73 | 58.98 | 6.25 | 0.142 | 4.863 | 0.5 | 0.014 | ||||||||||||||||

| including | 55.78 | 57.54 | 1.76 | 0.373 | 12.788 | 1.1 | 0.037 | |||||||||||||||||

| Connector | TET16210 | 16.95 | 60.91 | 43.96 | 0.096 | 3.275 | 30.6 | 0.402 | ||||||||||||||||

| including | 18.12 | 22.29 | 4.17 | 0.263 | 9.006 | 51.5 | 0.291 | |||||||||||||||||

| and | 51.90 | 53.26 | 1.36 | 0.296 | 10.150 | 19.6 | 0.583 | |||||||||||||||||

| and | 56.57 | 57.15 | 0.58 | 0.308 | 10.550 | 50.4 | 2.280 | |||||||||||||||||

| Connector | TET16210 | 131.83 | 135.60 | 3.77 | 0.076 | 2.614 | 52.5 | 0.140 | ||||||||||||||||

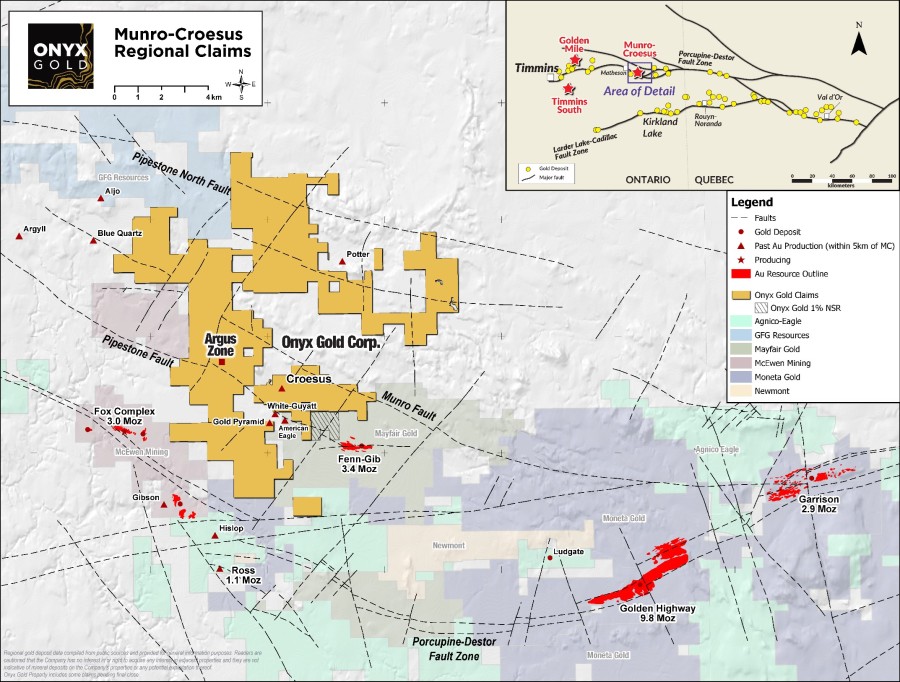

The accompanying map depicts the location of the core holes drilled during the 2016 Phase I drilling program.

About CORE

CORE is a Houston-based company that engages in the exploration in Alaska for gold and associated minerals through Peak Gold, LLC, its joint venture company with Royal Gold, Inc. Additional information can be found on our web page at www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding CORE that are intended to be covered by the safe harbor "forward-looking statements" provided by the Private Securities Litigation Reform Act of 1995, based on CORE’s current expectations and includes statements regarding future results of operations, quality and nature of the asset base, the assumptions upon which estimates are based and other expectations, beliefs, plans, objectives, assumptions, strategies or statements about future events or performance (often, but not always, using words such as "expects", “projects”, "anticipates", "plans", "estimates", "potential", "possible", "probable", or "intends", or stating that certain actions, events or results "may", "will", "should", or "could" be taken, occur or be achieved). Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks and uncertainties, which could cause actual results to differ materially from those, reflected in the statements. These risks include, but are not limited to: the risks of the exploration and the mining industry (for example, operational risks in exploring for, developing mineral reserves; risks and uncertainties involving geology; the speculative nature of the mining industry; the uncertainty of estimates and projections relating to future production, costs and expenses; the volatility of natural resources prices, including prices of gold and associated minerals; the existence and extent of commercially exploitable minerals in properties acquired by CORE; potential delays or changes in plans with respect to exploration or development projects or capital expenditures; the interpretation of exploration results and the estimation of mineral resources; the loss of key employees or consultants; health, safety and environmental risks and risks related to weather and other natural disasters); uncertainties as to the availability and cost of financing; inability to realize expected value from acquisitions; inability of our management team to execute its plans to meet its goals; and the possibility that government policies may change or governmental approvals may be delayed or withheld, including the inability to obtain any mining permits. Additional information on these and other factors which could affect CORE’s exploration program or financial results are included in CORE’s other reports on file with the Securities and Exchange Commission. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from the projections in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the time the statements are made. CORE does not assume any obligation to update forward-looking statements should circumstances or management's estimates or opinions change.