TORONTO, March 22, 2017 /CNW/ - Franco-Nevada's CEO, David Harquail, commented: "Our diversified portfolio continues to perform very well. In 2016, we exceeded our recently increased guidance ranges for both Gold Equivalent Ounces1 ("GEOs") and oil & gas revenues. The growth in 2016 is reflecting the contribution from acquisitions we made during the recent downturn and increased activity by many of the operators on our lands. Franco-Nevada has no debt and is growing its cash balances. We continue to see investment opportunities and Franco-Nevada has just agreed to acquire, for $110 million, oil & gas royalties on the Midland portion of the Permian Basin in Texas, U.S."

2016 Q4 Financial Highlights

- Record 129,036 GEOs delivered in the quarter, with 121,910 GEOs sold

- $155.3 million in revenue – a 28.0% increase over Q4/2015

- $122.2 million of Adjusted EBITDA2 or $0.69 per share

- $4.5 million of net loss, or $0.03 per share, reflecting impairment charges of $67.4 million on the Cooke 4 stream

- $42.9 million of Adjusted Net Income3 or $0.24 per share

2016 Full Year Financial Highlights

- 464,383 GEOs sold – a new record and a 29.0% increase year-over-year

- $610.2 million in revenue — a new record and a 37.6% increase year-over-year

- $489.1 million of Adjusted EBITDA2 or $2.79 per share

- $122.2 million of net income, or $0.70 per share

- $164.4 million of Adjusted Net Income3 or $0.94 per share

- $157.8 million of cash and DRIP dividends paid

- $253.0 million in cash and cash equivalents at year end and no debt

Revenue and GEOs by Asset Categories

Q4/2016 | Q4/2015 | ||||||||||

Revenue | GEOs | Revenue | GEOs | ||||||||

(in millions) | # | (in millions) | # | ||||||||

Precious Metals | |||||||||||

Gold | $ | 112.8 | 93,775 | $ | 88.0 | 79,800 | |||||

Silver | 21.9 | 18,650 | 18.9 | 17,112 | |||||||

PGM | 8.0 | 7,611 | 7.9 | 7,523 | |||||||

Precious Metals - Total | $ | 142.7 | 120,036 | $ | 114.8 | 104,435 | |||||

Other Minerals | 2.2 | 1,874 | 2.1 | 1,877 | |||||||

Oil & Gas | 10.4 | — | 4.4 | — | |||||||

$ | 155.3 | 121,910 | $ | 121.3 | 106,312 | ||||||

For Q4/2016, revenue was sourced 91.9% from precious metals (72.6% gold, 14.1% silver and 5.2% PGM) and 87.2% from the Americas (18.5% U.S., 22.3% Canada and 46.4% Latin America). Operating costs and expenses decreased slightly year-over-year, reflecting a realized gain of $14.1 million on the partial buy back of the Kirkland Lake NSR. Oil & gas revenue increased 136%, reflecting both higher prices and production levels year-over-year. Cash provided by operating activities was $121.9 million, an increase of 43.5% compared to Q4/2015.

Corporate Updates

- Credit Facilities: On March 22, 2017, Franco-Nevada extended the term of its existing $1 billion credit facility from November 12, 2020 to March 22, 2022. In addition, on March 20, 2017, Franco-Nevada's subsidiary, Franco-Nevada (Barbados) Corporation, entered into an unsecured revolving credit facility which provides for the availability of up to $100 million in borrowings.

- Midland oil & gas royalties: On March 13, 2017, Franco-Nevada agreed to purchase a portfolio of oil & gas royalties in the Midland shale play of the Permian Basin of Texas for $110 million. Closing is expected in the second quarter of 2017.

- STACK oil & gas royalties: On December 19, 2016, Franco-Nevada acquired a $100 million portfolio of oil & gas royalty rights in the Sooner Trend, Anadarko Basin, Canadian and Kingfisher counties ("STACK") play in Oklahoma's Anadarko basin.

- Kirkland Lake royalty buy back: In October 2016, Kirkland Lake Gold exercised its option to buy back 1% of an overlying 2.5% net smelter return royalty for aggregate cash consideration of $30.3 million. Franco-Nevada recorded a gain on disposal of $14.1 million.

- Cooke 4 stream impairment: In October 2016, Sibanye Gold Limited announced that it had ceased production at the Cooke 4 mine. Franco-Nevada recorded an impairment charge of $67.4 million.

- Antapaccay stream: On February 26, 2016, Franco-Nevada acquired a $500 million precious metals stream from Glencore plc with reference to production from the Antapaccay mine located in Peru.

- Equity financing: On February 19, 2016, Franco-Nevada completed a bought deal financing with a syndicate of underwriters for 19.2 million common shares at $47.85 per common share. Net proceeds were $884.3 million.

2017 Guidance

In 2017, Franco-Nevada expects attributable royalty and stream production to total 470,000 to 500,000 GEOs from its mineral assets and revenue of $35 million to $45 million from its oil & gas assets. Of the royalty and stream production, 335,000 to 345,000 GEOs are expected from Franco-Nevada's various stream agreements. For 2017 guidance, silver, platinum and palladium metals have been converted to GEOs using assumed commodity prices of $1,200/oz Au, $17.50/oz Ag, $950/oz Pt and $750/oz Pd. The WTI oil price is assumed to average $50 per barrel with a $3.50 per barrel price differential between the Edmonton Light and realized prices for Canadian oil. The Company estimates depletion expense of $265 million to $295 million. 2017 guidance and 2021 outlook below is based on assumptions including the forecasted state of operations from our assets based on the public statements and other disclosures by the third-party owners and operators of the underlying properties (subject to our assessment thereof).

2021 Outlook

Our outlook to 2021 further assumes that the Cobre Panama project will be ramping up production in 2019. At the same time, scheduled fixed ounce payments from Midas/Fire Creek, Karma and Sabodala are expected to step down to longer term royalty or stream payments. Using the same commodity price assumptions as were used for our 2017 guidance (see above) and assuming no other acquisitions, Franco-Nevada expects its existing portfolio to generate between 515,000 to 540,000 GEOs by 2021. Oil & gas revenues at the same $50 per barrel WTI oil price assumption are expected to range between $55 million and $65 million.

Q4/2016 Portfolio Updates

- Precious Metals — U.S.: GEOs from U.S. precious metals assets increased by 14.5% year-over-year with decreases from Goldstrike being more than offset by payments received from the South Arturo mine. GEOs received from the U.S. precious metal assets were 22,971 GEOs.

- South Arturo (4-9% royalty) – This project, operated by Barrick and Premier Gold, poured its first gold in August. Q4/2016 payments represented 8,808 GEOs. The partners are looking at a second open pit (Dee) on the property and are advancing permitting for the El Nino underground opportunity below the current pit.

- Goldstrike (2-4% royalty & 2.4-6% NPI) – Barrick is unitizing Goldstrike in an effort to reduce AISC by $100 per ounce which would benefit the profit royalty.

- Bald Mountain (0.875-5% royalty) – Kinross reported that it has doubled reserves at this project to 2.1 million gold ounces.

- Stillwater (5% royalty) – Stillwater Mining now anticipates that the Blitz project will add between 270,000 and 330,000 PGM ounces of incremental production annually when fully ramped up by 2021-2022.

- Precious Metals — Canada: GEOs from Canadian precious metals assets increased by approximately 8.6% to 20,849 GEOs compared with Q4/2015.

- Hemlo (3% royalty & 50% NPI) – The main contributor to the increase in Canadian GEOs was the Hemlo NPI. Barrick has increased reserves at Hemlo including the Interlake and C-Zone Deep zones to which the royalties apply.

- Hardrock (3% royalty) – Centerra Mining and Premier Gold presented a feasibility for a 14.5 year project with production averaging 300,000 gold ounces per year. A draft EA has been submitted.

- Detour (2% royalty) – Detour Gold has had challenges in getting approvals for its West Detour pit and is expected to provide an alternative mine plan.

- Holloway (sliding scale royalty) – In Q4, Kirkland Lake Gold announced its intention to put Holloway on care and maintenance. The Holloway royalty property encompasses the Holt mine property on which Franco-Nevada also receives royalties. Mining at Holt is expected to extend onto the Holloway property in the near term. At December 31, 2016, Franco-Nevada has recovered its initial investment in the Holloway mine.

- Brucejack (1.2% royalty) – Pretium Resources expects to begin commissioning of the underground mine in mid-2017.

- Timmins West (2.25% royalty) – Tahoe Resources expects to provide a reserve estimate for the Gap 144 zone in Q3/2017.

- Precious Metals — Latin America: GEOs from Latin American precious metals assets represented the largest year-over-year increase due to the addition of the Antapaccay stream. Precious metal GEOs earned from Latin America were 60,808 GEOs, an increase of 26.0% year-over-year.

- Antapaccay (gold and silver stream) – Antapaccay delivered 22,927 GEOs in Q4/2016, for a total of 73,612 GEOs in 2016.

- Antamina (22.5% silver stream) – Antamina delivered 10,619 GEOs during the quarter compared to 13,021 GEOs in Q4/2015, reflecting adjustments for final settlements of provisionally priced sales. For the full year 2016, Antamina delivered 60,273 GEOs.

- Candelaria (gold and silver stream) – Candelaria earned 19,698 GEOs, compared to 21,846 GEOs in the prior year quarter, as expected according to its mine plan. Since acquisition, contained copper and gold in the reserves have increased by approximately 50% when mined depletion is included and the production profile has significantly improved.

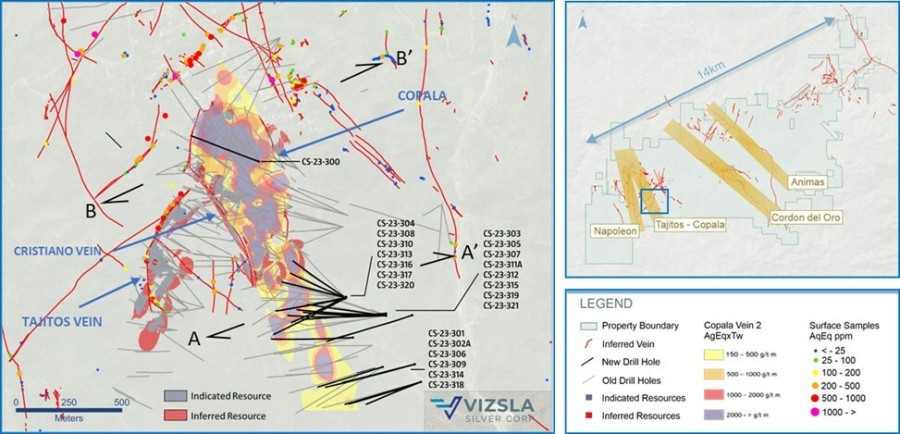

- Guadalupe (50% gold stream) – The 400,000 minimum ounce Palmarejo obligation was paid and fully met by Coeur Mining in Q3. That resulted in the original Palmarejo gold stream being terminated and the new Guadalupe stream commencing. During Q4, Franco-Nevada received 7,058 GEOs under the new Guadalupe agreement.

- Cobre Panama (gold and silver stream) – During the quarter, Franco-Nevada contributed $46.6 million of its share of construction capital for the Cobre Panama project. Franco-Nevada at quarter end has contributed $462.2 million of its total $1 billion commitment for the construction of Cobre Panama. First Quantum reported that the project was 46% complete as of year end and that initial production in expected in late 2018 with ramping up through 2019. Franco-Nevada expects to contribute between $200-$220 million to the project in 2017.

- Precious Metals — Rest of World: GEOs from Rest of World precious metals assets were 15,408 GEOs during the quarter, a 9.0% decrease year-over-year. This reflected lower production at MWS and that a portion of ounces delivered from Karma and Sabodala had not been sold as at quarter end.

- Karma (fixed gold deliveries and stream) – 3,750 GEOs were delivered in the quarter of which 2,500 were sold in Q4/2016.

- Sabodala (fixed gold deliveries and stream) – 5,625 GEOs were delivered in the quarter, of which 3,750 were sold in Q4/2016. Teranga Gold won the PDAC award for Environmental & Social Responsibility for its work around the Sabodala mine.

- Edikan (1.5% royalty) – Perseus Mining completed an upgrade to the plant in October 2016 and is now reporting improved operating performance.

- Sissingué (0.5% royalty) – Perseus Mining reports that this project has been in full scale development since July 2016 and expects first production in the March 2018 quarter. Perseus has also secured financing of $40 million to complete the development of the project.

- Cerro Morro (2% royalty) – Yamana is targeting a Q2/2018 start-up.

- Tasiast (2% royalty) – Kinross continues to advance development of the Tasiast Phase One expansion and expects to provide a feasibility for a possible Phase Two expansion in Q3/2017.

- Subika (2% royalty) – Newmont Mining is expected to make a decision in the first half of 2017 regarding the underground development of Subika and expanding the Ahafo mill.

- Agi Dagi (2% royalty) – Alamos Gold has tabled a positive feasibility for the project projecting annual production of 177,600 ounces of gold over 5 years. A positive PEA was also completed for the neighboring Camyurt project on which Franco-Nevada also holds a royalty

- Oil & Gas: Revenue from oil & gas assets increased to $10.4 million in Q4/2016 compared to $4.4 million in Q4/2015, reflecting both higher prices and production levels year-over-year.

- Acquisition of U.S. Oil & Gas Royalties – Midland Basin: On March 13, 2017, Franco-Nevada, through its wholly-owned U.S. subsidiary, agreed to purchase a package of royalty rights in the Midland Basin of West Texas for a price of $110 million. The Midland Basin forms the eastern portion of the broader Permian Basin and represents one of the most active and profitable oil plays in North America. The royalties consist of approximately 97% mineral title rights, along with some GORRs, which apply to approximately 908 acres (net after royalties) that, with pooling, provides exposure to an estimated gross acreage of 675,000 acres (a significant portion of the overall Midland Basin) at an estimated average royalty rate of 0.14%. The royalties are subject to a diverse operator base, which is anchored by Pioneer Natural Resources. Royalty revenue is expected to grow in future years as horizontal drilling activity in the area continues to ramp up. The transaction is expected to close in the second quarter of 2017.

Shareholder Information and 2017 Asset Handbook

The complete Consolidated Annual Financial Statements and Management's Discussion and Analysis can be found today on Franco‑Nevada's website at www.franco-nevada.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Management will host a conference call tomorrow, Thursday, March 23, 2017 at 11:00 a.m. Eastern Time to review Franco‑Nevada's 2016 results, as well as discuss the 2017 and five-year outlook. In addition, Franco-Nevada will be releasing its 2017 Asset Handbook with updated disclosures on our assets and the number of gold ounces and royalty equivalent units associated with each asset.

Interested investors are invited to participate as follows:

- Via Conference Call: Toll-Free: (888) 231-8191; International: (647) 427-7450

- Conference Call Replay until March 30: Toll-Free (855) 859-2056; Toronto (416) 849-0833; Pass code 66380664

- Webcast: A live audio webcast will be accessible at www.franco-nevada.com

Corporate Summary

Franco-Nevada Corporation is the leading gold-focused royalty and stream company with the largest and most diversified portfolio of cash-flow producing assets. Its business model provides investors with gold price and exploration optionality while limiting exposure to many of the risks of operating companies. Franco-Nevada is debt free and uses its free cash flow to expand its portfolio and pay dividends. It trades under the symbol FNV on both the Toronto and New York stock exchanges. Franco-Nevada is the gold investment that works.

For more information, please go to our website at www.franco-nevada.com.