HOUSTON--(BUSINESS WIRE)--Contango ORE, Inc. (“CORE” or the “Company”) (OTCQB: CTGO) is pleased to announce updated estimates of mineralized material1 for the Main and North Peak areas which are operated by the Peak Gold, LLC joint venture (“Peak Gold”) in Eastern Alaska. The measured and indicated resources2 were calculated with resource cones at a gold price of $1,200 per ounce with a cut-off grade of 0.5 grams per tonne and at $1,400 gold with a cut-off grade of 0.43 grams per tonne.

| Measured and Indicated within $1200/oz Gold Pit Shell at a 0.50 g/t AuEq Cut-off Grade | |||||||||||||||||||||

| Grade > Cut-off | Contained Metal | ||||||||||||||||||||

| Tonnage | Au | Ag | Cu | Au | Ag | Cu | |||||||||||||||

| Class | (kt) | (g/t) | (g/t) | (%) | (k oz) | (k oz) | (M lbs) | ||||||||||||||

| Measured | 484 | 6.25 | 16.73 | 0.15 | 97.3 | 260.4 | 1.6 | ||||||||||||||

| Indicated | 10,117 | 3.51 | 14.06 | 0.16 | 1,142.6 | 4,573.3 | 35.7 | ||||||||||||||

| M&I | 10,601 | 3.64 | 14.18 | 0.16 | 1,239.9 | 4,833.7 | 37.3 | ||||||||||||||

| Equivalent Gold (g/t) = Au (g/t) + 0.0122 x Ag (g/t) | |||||||||||||||||||||

| Measured and Indicated within $1400/oz Gold Pit Shell at a 0.43 g/t AuEq Cut-off Grade | |||||||||||||||||||||

| Grade > Cut-off | Contained Metal | ||||||||||||||||||||

| Tonnage | Au | Ag | Cu | Au | Ag | Cu | |||||||||||||||

| Class | (kt) | (g/t) | (g/t) | (%) | (k oz) | (k oz) | (M lbs) | ||||||||||||||

| Measured | 486 | 6.22 | 16.65 | 0.15 | 97.2 | 260.2 | 1.6 | ||||||||||||||

| Indicated | 10,808 | 3.34 | 13.97 | 0.16 | 1,159.5 | 4,854.5 | 38.0 | ||||||||||||||

| M&I | 11,294 | 3.46 | 14.09 | 0.16 | 1,256.7 | 5,114.7 | 39.6 | ||||||||||||||

Aggregate mineralized material, of which measured and indicated resources as shown above are a subset3, at various cutoff grades are show below.

| Grade > Cut-off | Contained Metal | ||||||||||||||||||||

| Cut-off | Tonnage | Au | Ag | Cu | Au | Ag | Cu | ||||||||||||||

| (g/t AuEq) | (kt) | (g/t) | (g/t) | (%) | (k oz) | (k oz) | (M lbs) | ||||||||||||||

| 0.30 | 18,142 | 2.62 | 13.64 | 0.15 | 1,526 | 7,957 | 61 | ||||||||||||||

| 0.40 | 16,730 | 2.81 | 14.23 | 0.16 | 1,514 | 7,656 | 58 | ||||||||||||||

| 0.50 | 15,650 | 2.98 | 14.68 | 0.16 | 1,502 | 7,387 | 55 | ||||||||||||||

| 0.60 | 14,702 | 3.15 | 15.10 | 0.16 | 1,488 | 7,139 | 52 | ||||||||||||||

| 0.70 | 13,883 | 3.30 | 15.38 | 0.16 | 1,474 | 6,864 | 49 | ||||||||||||||

| 0.80 | 13,110 | 3.46 | 15.66 | 0.16 | 1,458 | 6,602 | 47 | ||||||||||||||

| 0.90 | 12,378 | 3.62 | 15.94 | 0.16 | 1,442 | 6,343 | 45 | ||||||||||||||

| 1.00 | 11,663 | 3.80 | 16.14 | 0.16 | 1,423 | 6,053 | 42 | ||||||||||||||

| Equivalent Gold (g/t) = Au (g/t) + 0.0122 x Ag (g/t) | |||||||||||||||||||||

Brad Juneau, the Company’s President and CEO, commented, “The results obtained by Peak Gold through drilling this past year have been outstanding. When compared to our previous estimates released in 2013, using the same geologic assumptions, this new estimate represents an increase of approximately 59% of mineralized material. As shown on the tables above, we now have substantial quantities of measured and indicated resources relative to inferred resources, the result of substantially more drilling over the past year defining the known deposits already discovered at Main and North Peak.

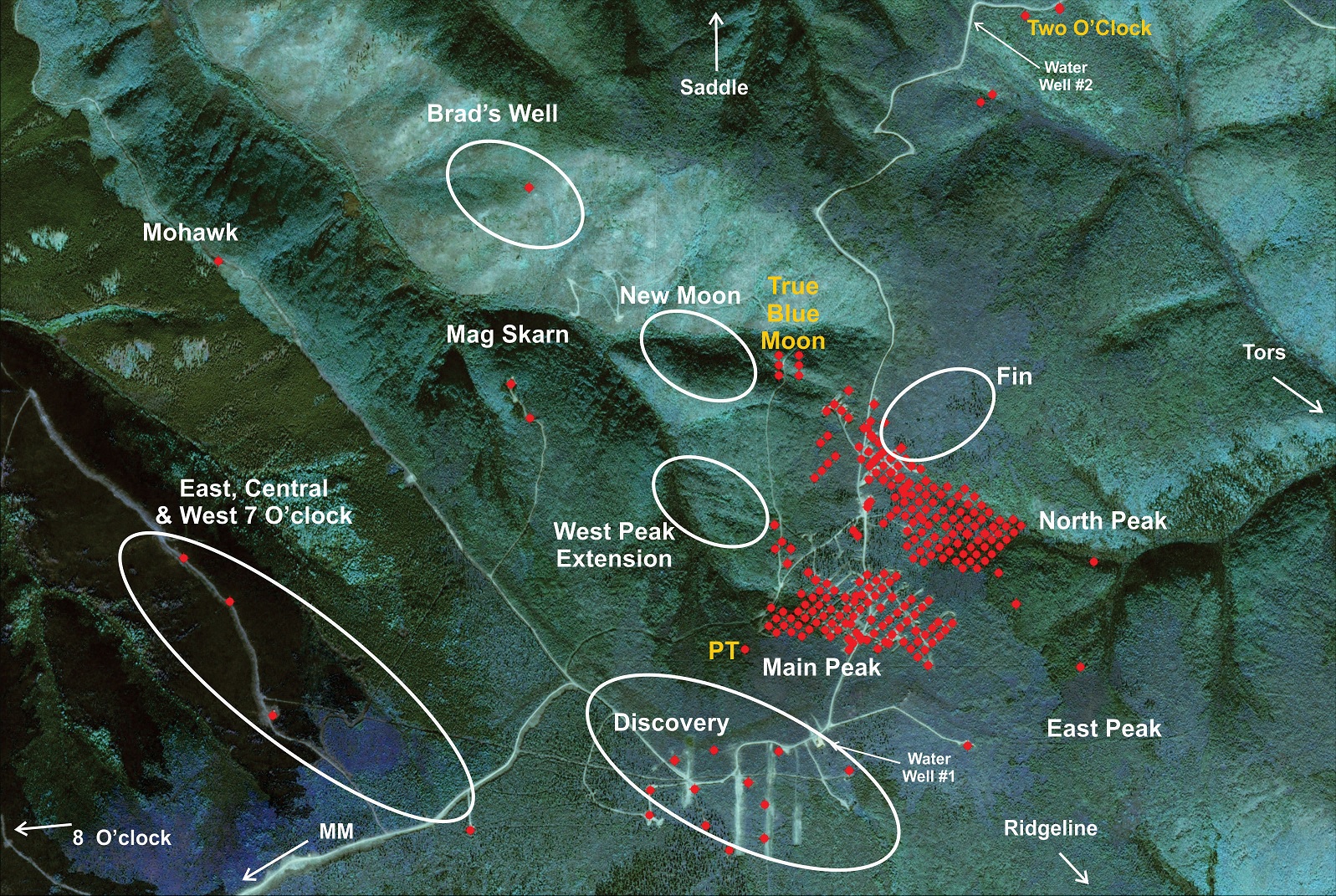

Having discovered and now defined a substantial body of ore, our drilling plans for the summer of 2017, which commenced in mid- May, are targeted towards more exploratory prospects in the general area of the Main and North Peak deposits. The attached map shows some of these targets, which are based on a variety of geologic/geophysical parameters employed by the technical team at Peak Gold. We also plan to do surface recon work on the recently acquired Noah claims as well as Tetlin Hills areas not previously sampled in detail in an effort to determine if drilling on these areas is warranted.”

Figure 1. The ovals on the map depict the target drill areas for the Phase II 2017 drilling program. The total acreage represented by this map is approximately 2,500 acres.

ABOUT PEAK GOLD

Peak Gold is a joint venture between CORE and Royal Alaska, LLC (“Royal Alaska”), a wholly-owned subsidiary of Royal Gold, Inc. Peak Gold holds a 675,000 acre lease with the Native Village of Tetlin and an additional 168,200 acres of State of Alaska mining claims, all located near Tok, Alaska, on which Peak Gold explores for minerals. Royal Alaska has the right to earn up to a 40% membership interest in Peak Gold by making total contributions of up to $30 million to Peak Gold by October 21, 2018. As of March 31, 2017, Royal Alaska had contributed approximately $20 million to Peak Gold and held a 24.9% membership interest in the joint venture, with CORE owning the remaining 75.1%. Once Royal Alaska has earned a 40% interest in the joint venture, CORE can be required to sell up to 20% of its net interest in Peak Gold should Royal Alaska sell its entire 40% interest to a bona fide third party purchaser.

ABOUT CORE

CORE is a Houston-based company that engages in the exploration in Alaska for gold and associated minerals through Peak Gold, LLC, its joint venture company with Royal Alaska, LLC. Additional information can be found on our web page at www.contangoore.com.